“Do not wait until the conditions are perfect to begin. Beginning makes the conditions perfect.”

-Alan Cohen

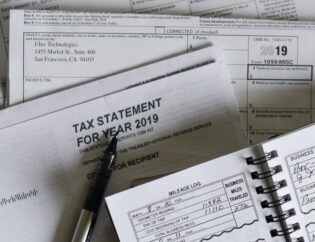

ORDER 1099 and W2 forms or software

CONFIRM that all W-2 related year end calculations and adjustments have been made for things like personal use of company auto, deferred compensation plan contributions, employee business expense reimbursements, and taxable fringe benefits.

CHECK W-2’s to ensure that the names and Social Security Numbers are correct. The IRS will penalize you for having incorrect Social Security Numbers and they must be issued to employees no later than January 31st.

SCHEDULE Bonuses & remind employees to use flexible spending funds if they expire at year end.

ISSUE an IRS form 1099 by January 31 to all non-employee individuals and non-incorporated businesses paid more than $600 during the calendar year for services, rent, prizes, awards, and legal fees.

FILE for 1096 along with copies of each 1099 with the IRS by February 28, 2021.

REQUEST updated W4 forms from employees who information has changed.

Internal File Maintenance Checkup

Make sure you have the following items filed away from the past 3 years, for your employees and your business:

Business File Items:

- Payroll certificates

- Contracts agreements

- Benefit plan documents

- Benefit eligibility specifications

Employee File Items:

- Completed IRS W4 Form

- Offer letter or information sheet with Work Schedule, Pay Rate, Benefits, Payroll adjustments

- Hourly employees documentation of OT pay